What is a Verification Form?

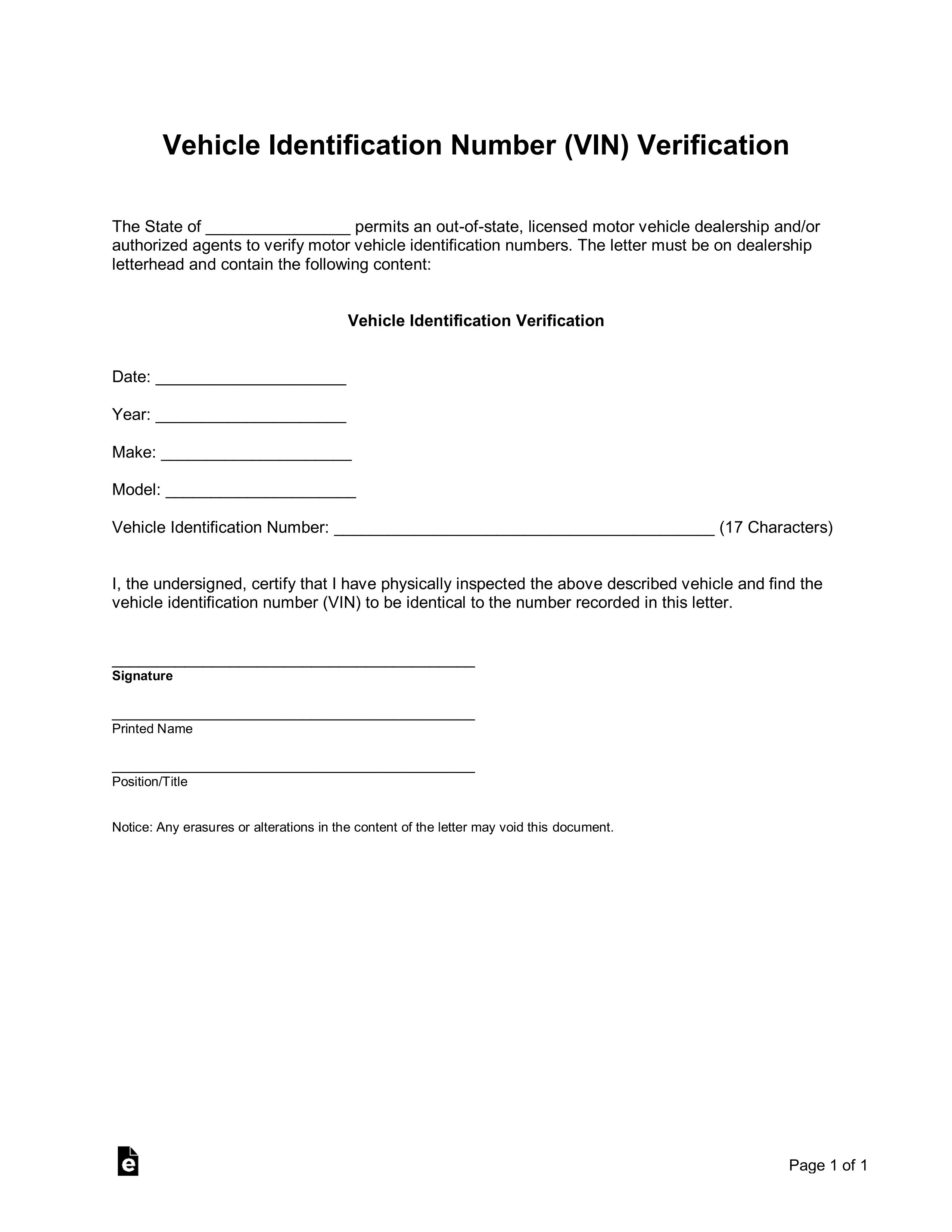

A verification form is a certificate that is used to find out the status of an individual. Through this process, a third-party does all the work and provides documents and other related data that makes sure your individuality is a separate entity.

This helps you in confirming your place as a member of society. Different verification forms work differently, and with the help of the third-party, one can find out the target information about that particular person.

The authenticity of that person will be proved by using a letter, document, certificate, or other similar ways. At the end, when the form will be completed, the requested party is supposed to sign it.

Different Types of Verification Forms

Different types of verification forms are being used for other purposes. Look at the below list to find out which ones are the primary ones that are primarily used in various life spheres.

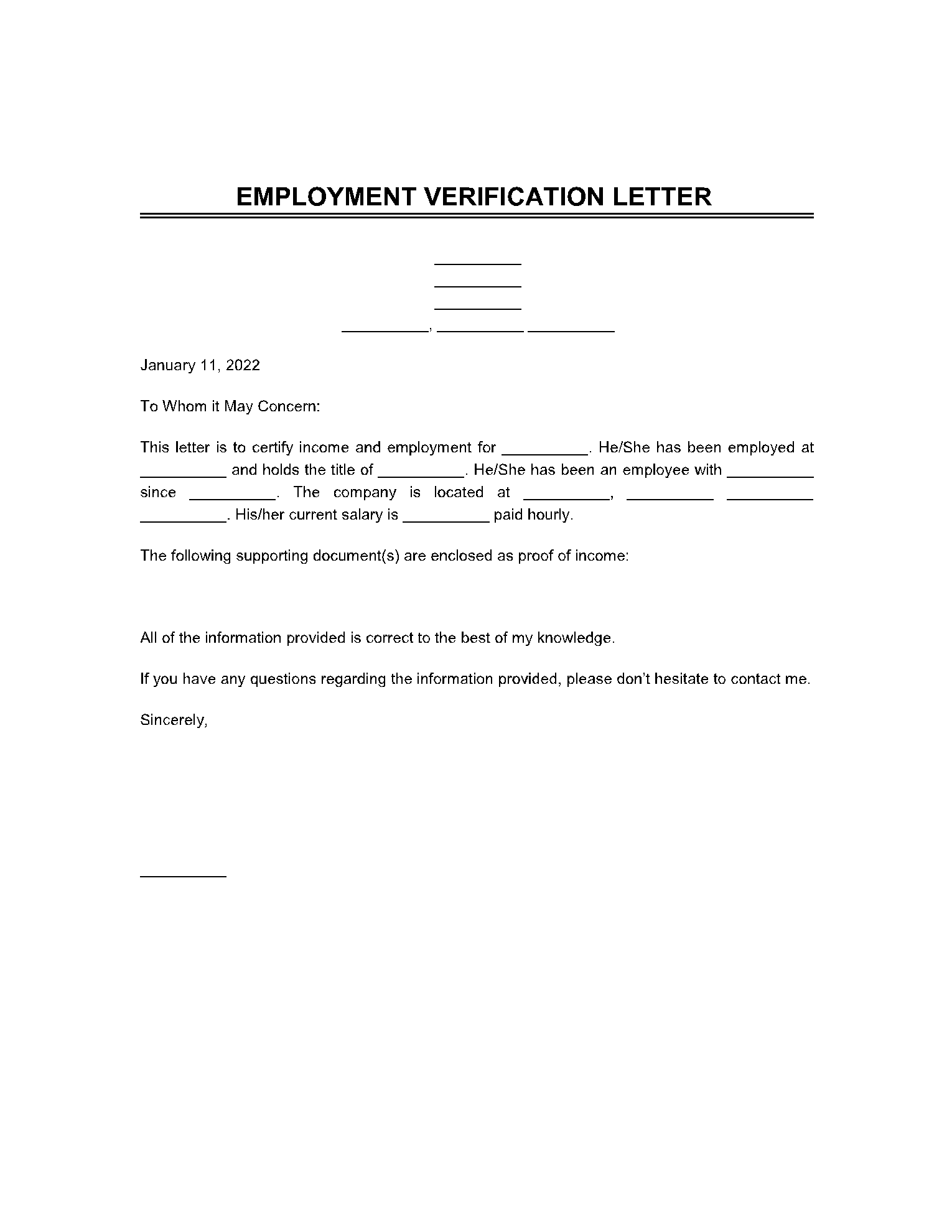

Employment Verification Letter

An employment verification letter is used when for some reason, the authenticity of your job is required. It helps the requested party in knowing whether or not you are an employee of a particular organization. Many other things can be associated with this kind of verification form as needed at different levels.

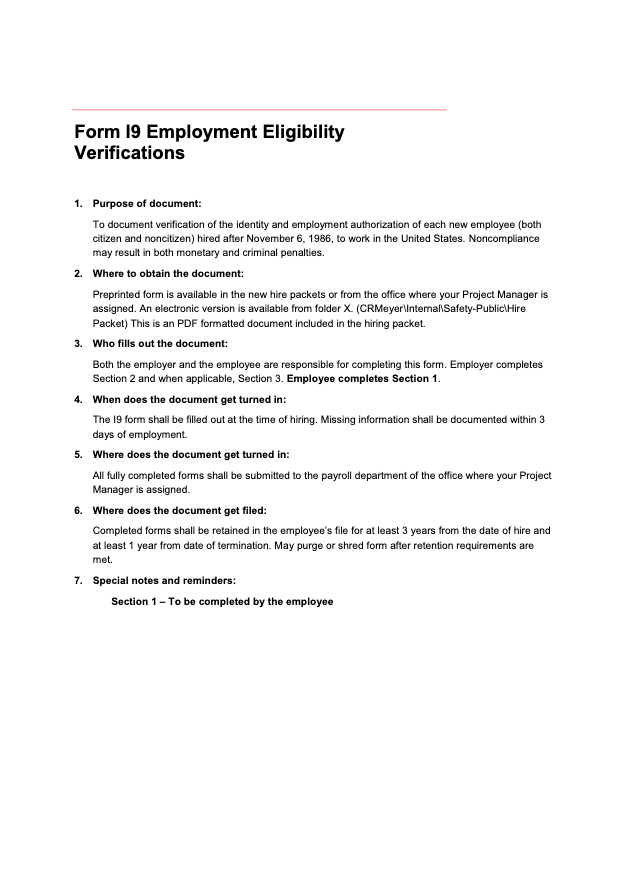

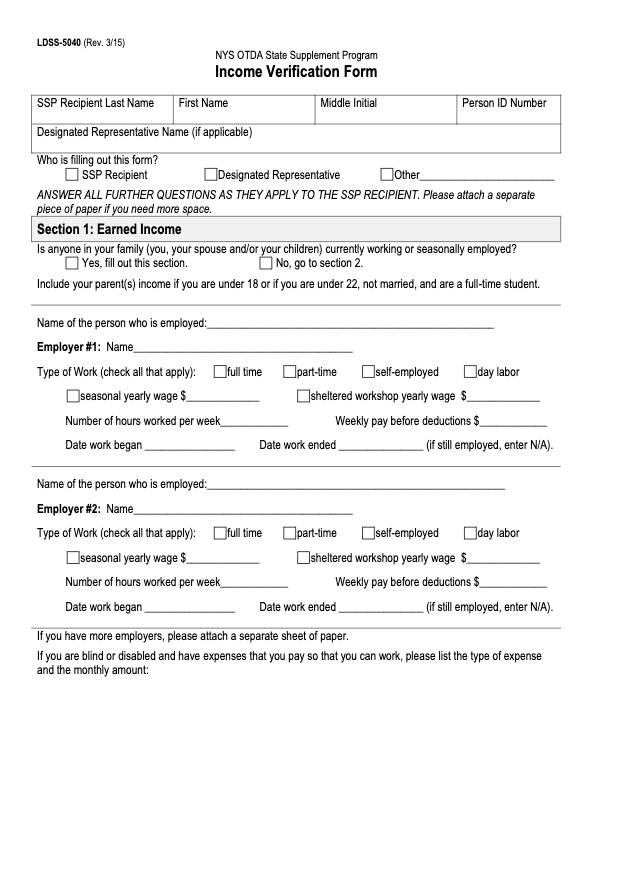

Income Verification Letter

This type of letter is made for the sake of explaining the financial status of your employment. An income verification form is completed for the sake of verifying that you are working at someone from where you take monthly, weekly, or daily wages.

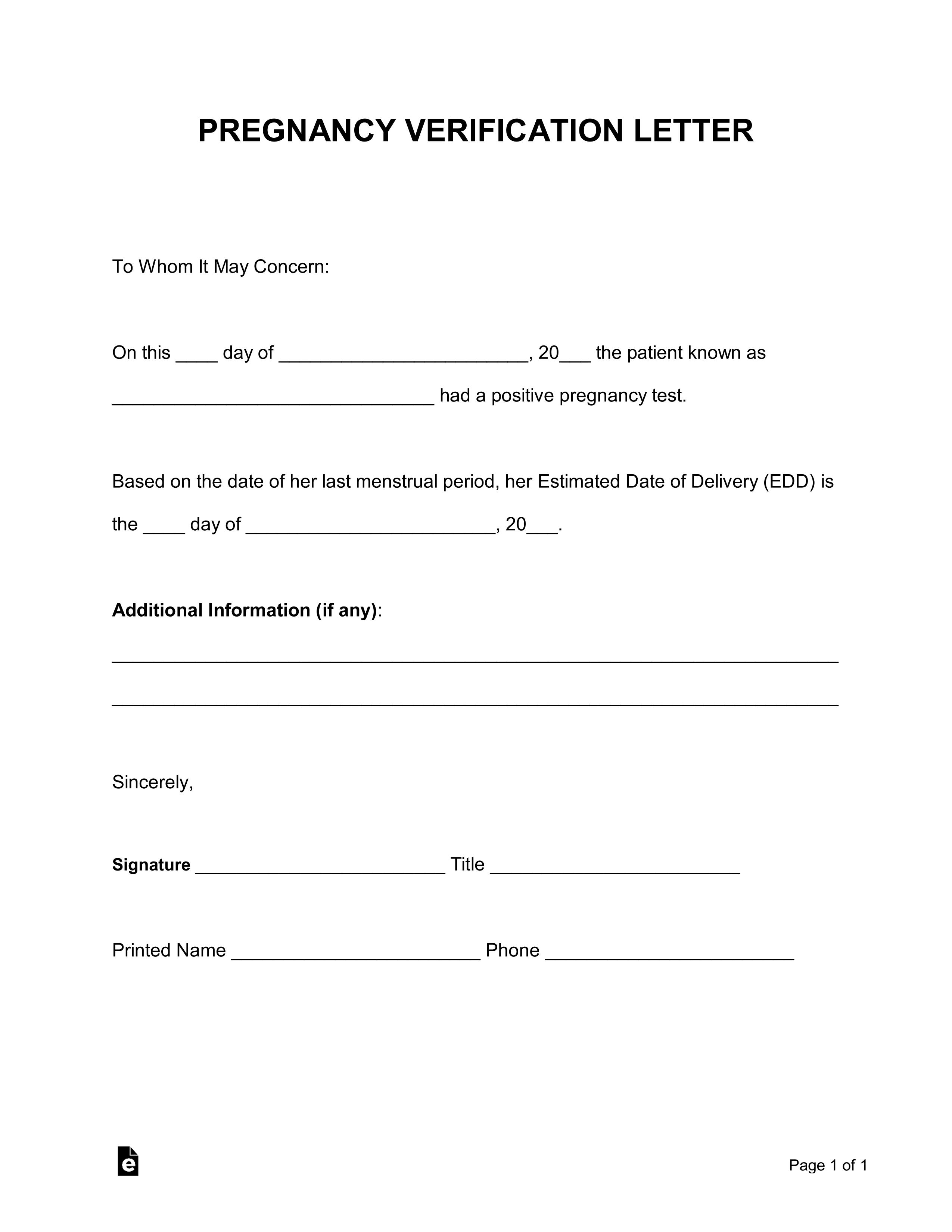

Pregnancy Verification Letter

This form is filled to determine what a particular woman is expecting and her pregnancy is due. By filling out pregnancy papers, they can prove the claim's authenticity as the desired party can see the form and know that the claim is correct because the physician signs it.

Health Insurance Verification Letter

This form lets you enjoy some excellent perks based on your account status and lets your health facilitator know how health insurance class you fall into. It states the facts and based on it, and you can take particular benefits in healthcare.

Why is Verification Important?

Verification is essential for several reasons. It highlights the situations of your overall or a particular area of your life. With the help of ensuring your authenticity, you can move into society at different levels. Sometimes you need to verify your wages’ status. Sometimes you are supposed to let people know about your employment.

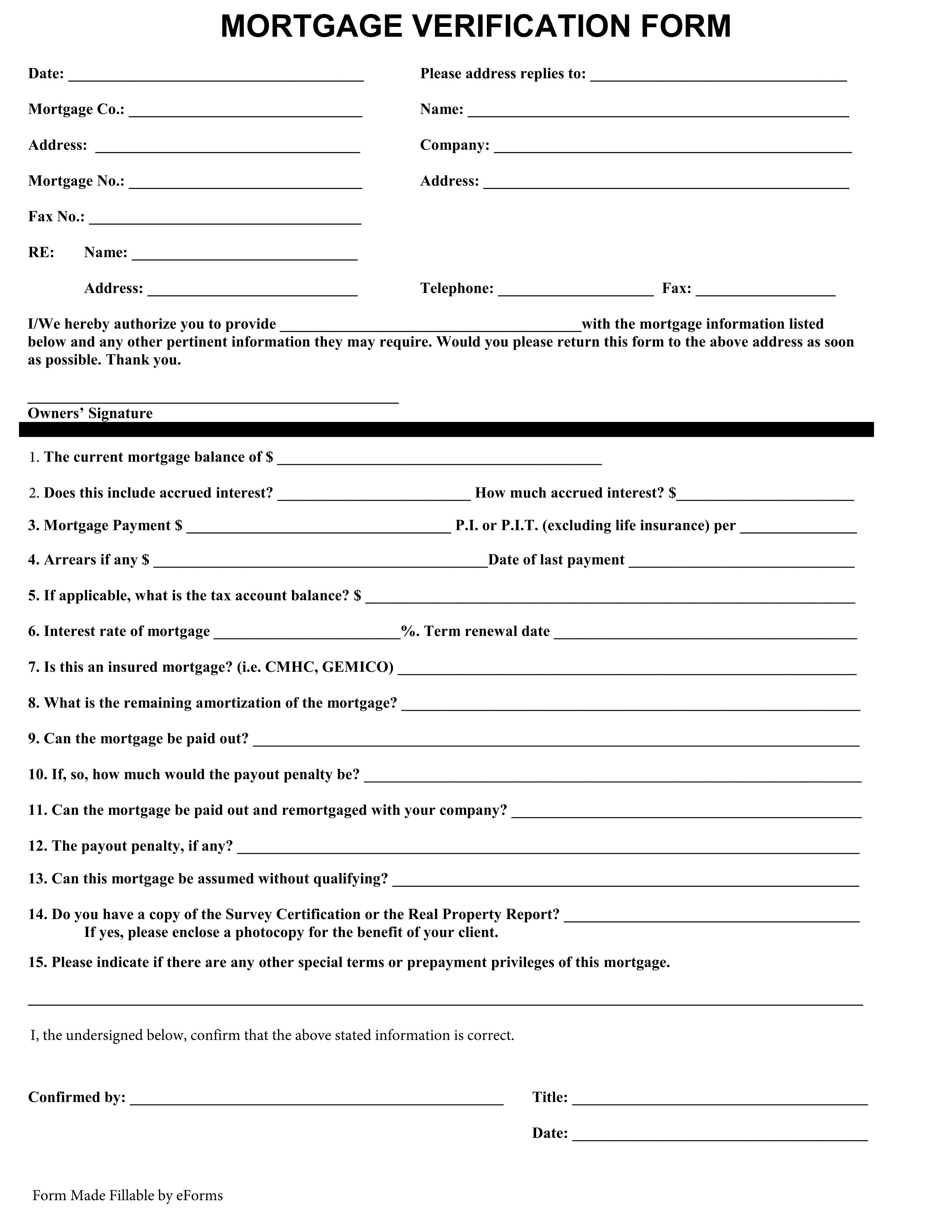

At times, you have to verify your pregnancy; at other times, you need to take the loan and verify your account history so you can move quickly without getting stuck because you cannot prove that specific department’s status.

How to Use a Verification?

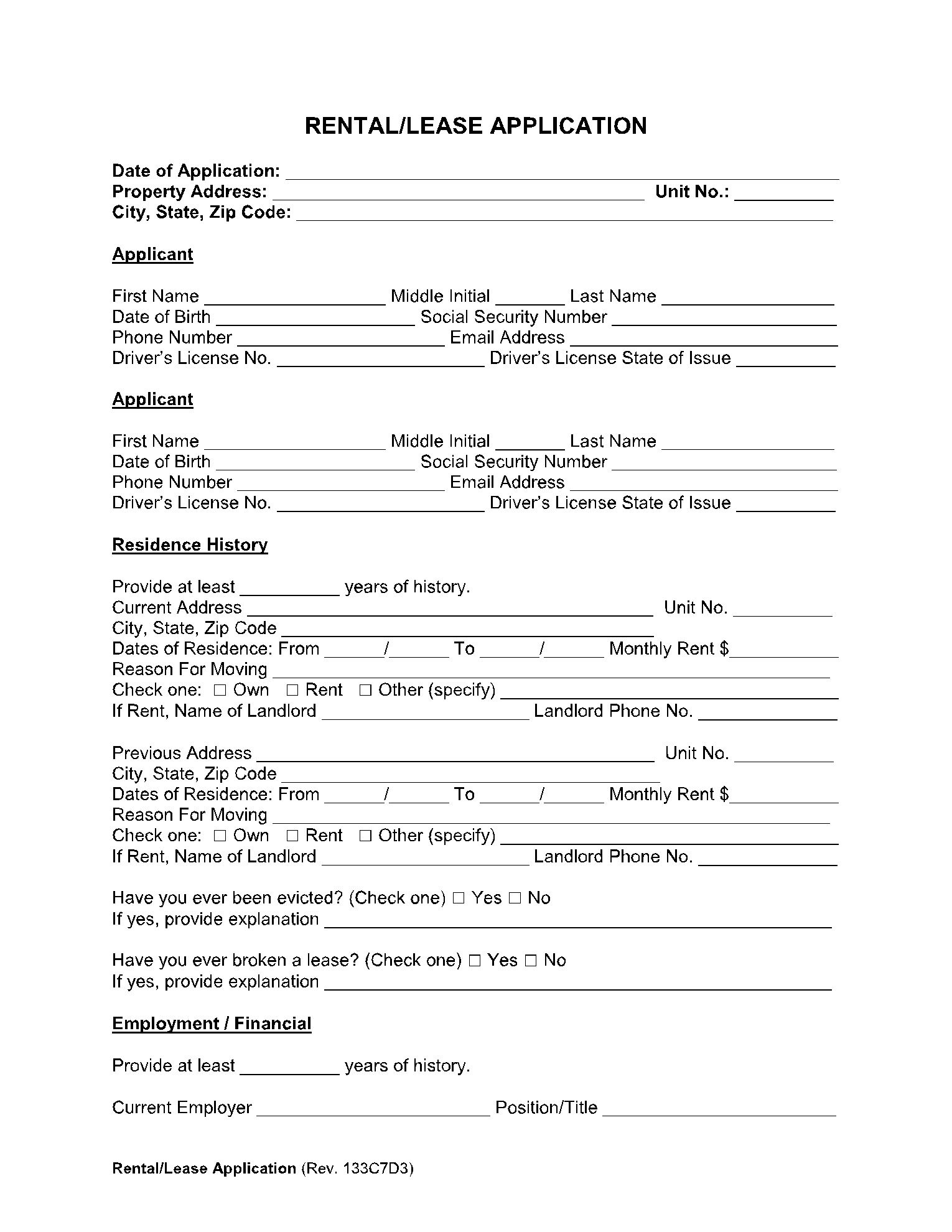

Different types of verifications work in different ways. Sometimes you need to go for the verification of employment; at other times, you need to fill a rental verification form. You are required to show pregnancy papers, but you have to go for an income verification letter.

All these situations vary for one another, but the purpose is the same. You need to let people know your status in that desired area that the organization was requesting or someone else from the higher authority.

The primary purpose is to authenticate your identity that can be proved with the help of the information you have in the same field. All of this will work by drawing the preferred information on you, and through this, you will be able to verify your status.

Employment Verification Letter

The employment verification letter is made for the sake of letting someone from the higher authority that someone is employing you. It includes a person or an organization. This type of verification's primary purpose is to let the requested party know that you are working with someone.

To prove that you are currently working somewhere as the verification letter has the signature, sometimes the stamp of the place you are still working or worked a while back. It helps you change the jobs as you can use this form as an experience letter that you have previously worked somewhere.

Income Verification Letter

The income verification letter is used as proof that you are taking monthly wages from an organization or from someone who employed you for your services. This letter is constructive when it comes to taking loans for one reason or another.

It states your current financial situation status and guides the financial institution to decide whether you can take the loan. In the latter cases, when you don't qualify in taking the loan, the issue is that you are not able to pay it back, or there are chances that you can't even pay for the initial charges that are being given as security.